IRR vs. Equity Multiple: Which Should You Use to Evaluate Your Investments?

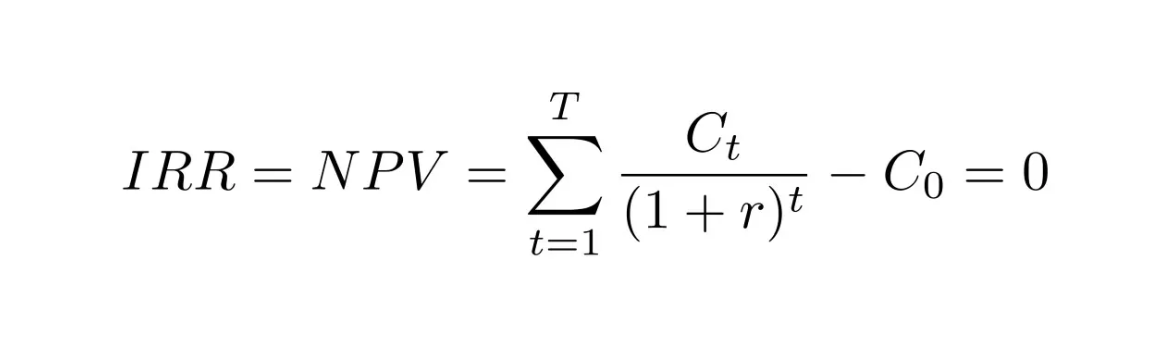

Internal Rate of Return (IRR) is a growth rate an investment is expected to generate and is calculated by setting the discount rate such that the NPV = 0 for an investment. IRR is often used in capital budgeting on deciding which investment to take and which one to forgo. You can calculate the IRR by using the following formula. Here is an online calculator which you can leverage for quick calculation.

According to the basic time-value of money, a dollar you have today is worth more than a dollar in the future. When evaluating two different investments,

With the same IRR the further in the future you received your earnings from an investment , the less valuable they are.

With the same cashflow, the larger the IRR, the more attractive your investments are potentially.

When deciding an IRR for an investment, the sooner the same earnings are received, the higher the IRR.

An Investment’s IRR is often used to compare investment options with different funding levels and/or time-horizons to find the best application of funds during a set period of time.

However, a project with a higher IRR does not necessarily mean it is a better investment. IRR calculations do not take into consideration the risk profile of a project or other variables potentially affecting overall return.

In principle, a higher IRR could translate to the same amount of cash received, but at an earlier time, and conversely a lower IRR could actually return more cash. The same IRR could also apply to two different equity multiples (EM). Here is an example:

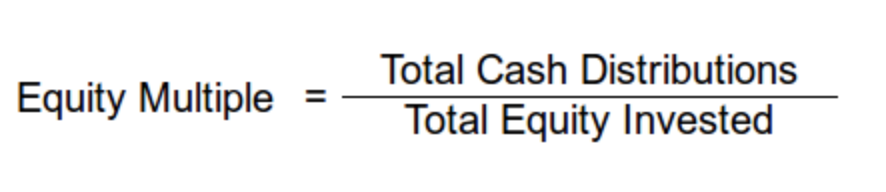

Equity Multiple

Equity Multiple (EM) is a ratio calculated by using the total cash distributions received from an investment, divided by the total equity invested. It is a common performance metrics used in commercial real estate evaluation.

The Equity Multiple of an investment is a simple aggregation of all cashflows. It neither takes into account when the return is made nor reflect the risk profile of the offering or any other variables potentially affecting the project’s return.

IRR vs. EM: which to use?

IRR and EM view a real estate investment from different perspectives, and both can provide valuable information when evaluating an investment.

For investors concentrated on the best application of funds over a shorter period of time, a stronger IRR might be more relevant.

For investors looking for a long-term return much larger than the initial investment, an offering’s equity multiple might be the best metric to study.

In either case, the equity multiple is helpful in understanding the actual amount of money coming back to the investor, but consider both when evaluating any real estate investment, and remember that neither guarantee financial performance and there are other risks which are not taken into consideration in practices.