What Can IRR Tell You About Your Real Estate Investment?

IRR (Internal Rate of Return) is the average annual return you can expect to receive over a certain amount of time, given a corresponding amount of cash flows. In this post we’ll explore the insights that IRR can tell us about a given real estate investment.

What Does The IRR Consist Of?

In order to calculate the IRR, we need the yearly cash flows of the investment property we are evaluating. The cash flows can normally be partitioned into two categories:

Cash Flow from Rent

Cash Flow from Sale of the Property

Once we know these, we can easily compute IRR with an online calculator, or using Excel. The IRR partition lets the investor know the weights of the IRR calculation. Simply put, we can determine how much of our IRR is coming from our rental income, and how much of it is coming from our projected sales price. Let’s dive into it. It can give insights on whether the investment is cashflow focus or equity focus.

Partitioning The IRR

Partitioning the IRR is a 4–step process:

Calculate IRR based on property cash flows

Calculate the Total Present Value of the cash flows using IRR as the discount rate

Divide the PV of Cash Flow from Rent by Total PV

Divide the PV of Cash Flow from Sale by Total PV

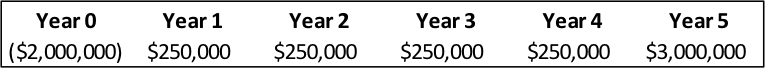

Let’s assume an investment property cost us $2,000,000 and would produce $250,000 in cash flows for 5 years, at which point we would sell it for $2,750,000. Here’s what our cash flows would look like:

These cash flows would allow the property to realize an IRR of 17.77% (not bad). In order to determine how much of the IRR is attributable to the Cash Flow from Rent and how much of it is attributable to the projected Cash Flow from Sale, we need to calculate the present value of the cash flows.

In other words, we want the dollars that we are receiving in future years to be stated in present day dollars. We can do this by using our IRR of 17.77% as the discount rate.

As the table shows, the sum of the total PV of the Cash Flow from Rent is $785,956 while the sum of the total PV of the Cash Flow from Sale is $1,214,044. This gives us a total PV of $2,000,000, which we can now use to help us complete steps 3 and 4 of our IRR partitioning:

3. Divide the PV of Cash Flow from Rent by Total PV

$785,956 ÷ $2,000,000 = 39.30%

4. Divide the PV of Cash Flow from Sale by Total PV

$1,214,044 ÷ $2,000,000 = 60.70%

There we have it. We now know that 39.30% of our IRR stems from our Cash Flow from Rent and 60.70% of our IRR is attributable to our projected Cash Flow from Sale. Now what can we infer from these proportions?

Interpreting The Partition

Investors are more certain in projecting cash flows that will stem from their existing leases.

There is more uncertainty surrounding the projected cash flow from sale, given that in most cases, it will depend on a forward NOI and an assumed Cap Rate. The value of the partitioned IRR lies in its separation of the more certain cash flow (rent roll) and the less certain cash flow (projected sale).

Our hypothetical investment yielded an IRR of 17.77%, of which 39.30% was attributable to our Cash Flow from Rent. If there was an alternative investment with the same IRR of 17.77%, but only 15% of the IRR was attributable to Cash Flow from Rent, we can infer that more risk is associated with the alternative investment as 85% of the IRR depends on the projected Cash Flow from Sale.

Making the final investment decision should not depend solely on a return statistic. It’s instructive to see what the return is actually composed of. Partitioning the IRR allows us to do this – it gives us the details needed to see the big picture.